I think most of you would be knowing about an Auction. Whether it is a Telecom auction, antique item auction or the most famous IPL auctions. The economics equalizes the demand and supply and make sure that the item reaches where it should.

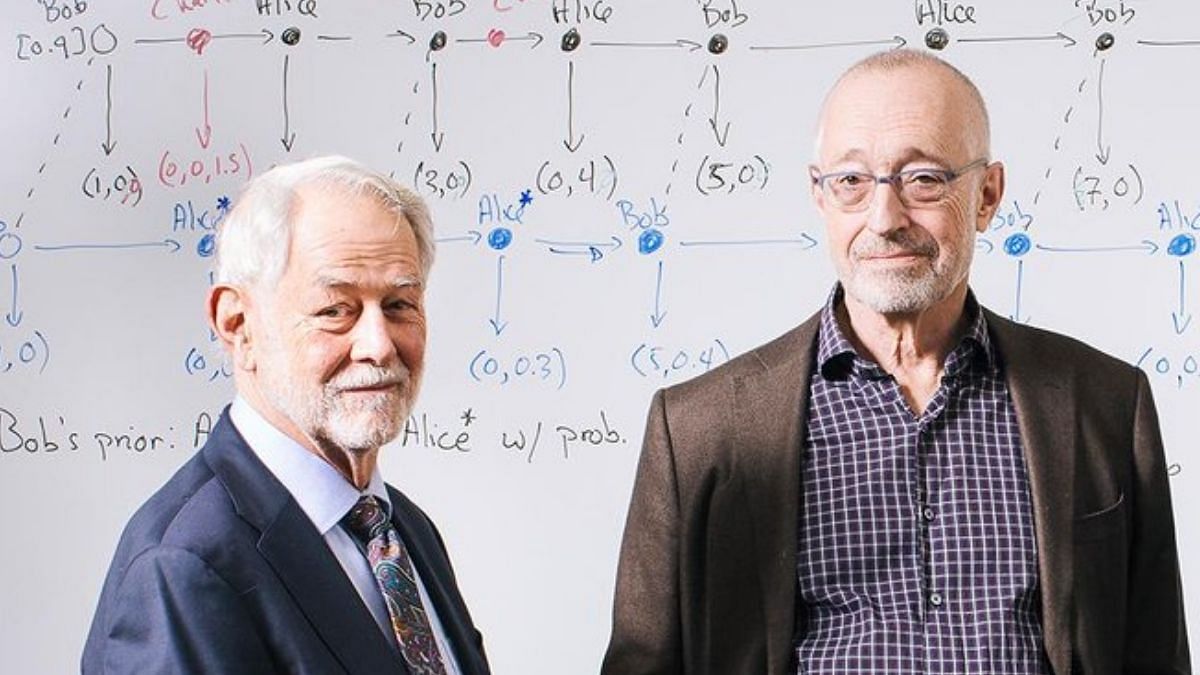

Why am I talking about it is because last year Nobel prize was won by two economists who worked in this area only. Nobel Prize in Economic Sciences went to Robert Wilson and Paul Milgrom. While the former talked about the common value’ that comes out at the end, examples of radio frequencies and minerals and also about the Winner’s Curse. The latter on the other hand, talked about more general way, auction formats and also knowing about the rival’s estimates.

Clearing out the Basics

The history of auctions can be traced back to the causes of appropriation and confiscation. While the earliest traces can be found from the ancient Rome, where confiscated assets of defaulters were sold through auctions. The purpose of even the oldest auction house, Stockholms Auktionsverk, was also appropriation of assets.

As we all know that primarily in an auction, the participants bid the price up to which they are ready to spend money to get the particular product. Well, the concept is not that simple as it seems. The two main things that a bidder has to keep in his mind not just his own budget (till what limit can he go) as well as the estimation about his rivals (till what level can and will they bid).

Some Important Terms

Some common terminologies that are used in the world of auctions can be explained as follows:

- PRIVATE VALUE : This refers to such values where every participant is giving his own value for the product. Now, that seems odd for sure and rarely happens, but its examples can be found for cases like charity events, where getting better of each other or beating others, is not the aim of the participants.

- COMMON VALUE : This refers to such values where the common consensus is built over a value, which can’t be bettered by any other participant. Here, the main problem arises while estimating the exact value where a participant will be able to get over his rivals. He has to estimate the value which is neither over nor under estimated.

- WINNER’S CURSE : This is very much connected with ‘Common Value’ cases. It happens when a winner wins the auction but loses morally. Consider, you are bidding for a Mango, now you don’t know what is the maximum ‘budget’ of your rival participants and up to which level can they bid. Suppose, you directly bid at 100 for the mango to ensure that only you is able to win it. Now, if the budget of your rivals is around 90, then it’s still okay. But, what if you come to know that your rivals only had a 50 rupee in their pocket and couldn’t have had bid for more. You have lost 50 extra rupees. This is ‘Winner’s Curse’.

The Reality

Now in real life scenario, both Common and Private values are present. Anyone who is participating in an auction is concerned with both; his own assessment and budget for the product as well as the expectations about what others can bid for it. Whether it’s a a natural gas company bidding for excavation rights or a bank purchasing government bonds; both will be considering its own prospects, capacities and feasibility as well as market conditions, sellable price and quality.

A major breakthrough in this regard came by Paul Milgrom who came up with many new insights, of which the most famous turned out to be the one describing ‘Types of Auctions’. So, on this very note let’s have a look at what are the different types of Auctions. Although, there are many forms of auctions, but two are the most important.

- ENGLISH AUCTION: In an English auction, the auction of a commodity starts from a lower price and subsequently rises till there is no one to bid any higher. Here, the bidders don’t have any information about the product and the seller also wants them to bid more so he gets more revenue. Clearly chance of Winner’s Curse is less here, since the price is gradually going up.

- DUTCH AUCTION: In a Dutch auction, the exact opposite happens and the auction starts from a higher price and subsequently comes down to a lower. Here, on the other hand, the seller himself wants bidders to know more so they stop at a higher price, before the price gets too low. So, there is no doubt that Winner’s Curse can happen very frequently, because while coming from up to down, the players don’t know where to stop.

- FIRST-PRICE AUCTION : This is a sealed-bid auction, where bidders give their bids in a sealed envelope and the highest bidder wins paying the highest price. Of course, here the guessing game, Game Theory and Winner’s Curse, all come into play.

- SECOND-PRICE AUCTION : This too is a sealed auction and here also the bidders give their bids in sealed envelops, but here the winner with the highest bid only has to pay the second highest price. So, though Game Theory and Guessing game is prevalent here but Winner’s Curse is less probable here.

It is found in the studies that English auctions are more revenue generating than the second-priced ones, which are subsequently more revenue generating than the First-Priced auctions and Dutch auctions.

The TELECOM Revolution

Earlier, in the United States the telecom frequencies of mobile calls and internet were simply distributed to the company which ‘looked’ perfect for the job, this method was also called ‘Beauty Contest’. But due to resentment against this method, government started distributing them randomly, which was an even worse method. But, as a blessing in disguise, due to the rising national debt in the US, the government was compelled to start auctioning the telecom rights from thereon. It was combined with the rising mobile telephony sector and finally the Federal Communications Commissions (FCC) decided about Auctioning in 1993.

Now, here arose the bigger problem, as it was not easy to devise the perfect way to auction telecom frequencies. One who purchases the rights in one particular district, must also be having the right in the nearby districts as well to bring forth an effective telephony network. But a buyer or a bidder does not know how much should he invest or bid in one district as he also has to keep other districts in mind. You can relate it to buying one big-ticket player in IPL keeping in mind the amount you have to keep for making the rest of the team.

The Invention of a New Method

The above problem, led the FCC to come up with a way to sell all the telecom frequencies in a particular geographical location in one go only. For this they needed a new method and this only was provided by our Nobel Lauretes Robert Wilson and Paul Milgrom; SIMULTANEOUS MULTIPLE ROUND AUCTION (SMRA). Here, all the rights were sold off simultaneously. Since, in this case, bids went from down to up, there was minimal room for speculations and getting a situation like Winner’s Curse.

This method turned out be a huge success as the first SMRA in 1994 sold 10 licenses worth 617 million dollars in 47 biddings. So, far this method is said to have brought more than 120 million dollars for FCC and 200 billion dollars globally. This method was followed by many countries like UK, Germany and even India and not just for electricity or natural gas but also for commodities like electricity and natural gas.

A Trendsetter for New Methods

This method laid the perfect pathway for new and innovative methods. Paul Milgrom was also the architect behind two more popular methods. The

- COMBINED CLOCK ACTION: In this auction, operators get to bid for ‘packaged’ form of individual licenses, rather than taking individual licenses. Among te two phases, initially, there is an Allocative phase within which; in the clock stage prices of all products are announced in multiple stages and bidders provide their bids. The prices fluctuate till final demand is established and then in the Supplementary phase, the bidders get the opportunity to supplement something more into their bids. Then in the Assignment stage, the products are finally assigned to the highest bidders. Here, the bidders need to be very smart and active as price of the packages change at a very quick pace.

- INCENTIVE AUCTION : This auction takes place in two rounds; the first one called the Reverse Auction to sell the licenses from the current holders to government and then the Forward Auction to subsequently sell it to other market players who can turn out to be efficient in managing the rights.

Then, some other auctions like PRODUCT-MIX Auctions and POSITION Auction are also there, which aim at selling interrelated products together in a package.

Conclusion

Interestingly, all they aimed initially was some basic research to study the behavior of buyers and sellers with different levels of information. But what they ended up doing was revolutionizing the whole Auction industry with their breakthrough and landmark invention. Their ground breaking but basic piece of research have been highly beneficial for not just the buyers and sellers but also for the society as a whole. The findings have allowed trained analysts to design new auctions and practitioners to choose more wisely among existing auction formats. Interestingly, the two economists Paul Milgrom and Robert Wilson have not just given the theories but have also figured out its applications. Further, not just for auctions but there theories have also given new insights into Game Theory, Trade Mechanism and even in some complex topics like Monotone Likelihood Ratio Property and Supermodularity. At last I would like to wrap by thanking and appreciating their brilliant effort.

Sources:

- Nobel Prize in economics awarded to Paul Milgrom and Robert Wilson https://www.dw.com/en/nobel-prize-in-economics-awarded-to-paul-milgrom-and-robert-wilson/a-55241005#:~:text=US%20economists%20Paul%20Milgrom%20and,the%20Nobel%20Committee%20announced%20Monday.

- Press release: The Prize in Economic Sciences 2020 https://www.nobelprize.org/prizes/economic-sciences/2020/press-release/