Just like every year, the Union Budget for the fiscal year 2023-24 was presented in the Parliament, and everybody became an economist at the fingertip. Overall, you all must have got to hear about some of the new announcements, especially regarding taxes, but we need to take a deeper look into the Budget to get a better understanding of where our economy is heading. If we go from the words of the government, Inclusive Development, Digital infrastructure in agriculture, Financial Sector, Green Growth, Youth Power, Unleasin the Potential, Infrastructure and Investment are the SAPTRISHI areas being focussed in the Budget, as per the government.

Some Major Allocations

- Two major announcements this year, namely, Agriculture Accelerator Fund to encourage agri startups, and Shri Anna to encourage the promote production and research of Millets.

- A major announcement in the Health area is regarding the eradication of Sickle Cell Anaemia by 2047. Under this, 7 crore people will be screened for samples.

- Special grants have been provided for research and development of ‘lab-grown Diamonds‘, which is an unique thing it itself.

- MISHTI (Mangrove Initiative for Shoreline Habitats & Tangible Incomes) has been announced for promoting mangrove plantation across the coastline.

- PM-PRANAM (Program for Restoration, Awareness, Nourishment and Amelioration of Mother Earth) has been announced for promoting states to incentivise fertilisers

- It was mentioned, that the Aspirational District Programs (which identifies backward districtsand works on their upliftment) has been very ‘successful’, and 95% of the identified districts, have shown significant improvement in health, nutrition, financial inclusion, and infrastructure. Now, the government will further identify 500 more such districts.

- The Defence Budget was hiked by 13% which is a good step, amid tensions with China. Also, this shows that the focus of the government lies in not enhancing teh size of teh army but in making it equipped in modern terms.

- National Green Hydrogen Mission was announced with the aim of making India a Net-Zero country by 2070. Rs 19,700 crore will be allocated for it, for producing five million tonnes of green hydrogen by 2030. Also, India’s Hydrogen Train was also announced, which is expected to start running in December 2023.

- National Data Governance Policy: Under this, the government will provide access to data to startups to identify problems and generate opportunities using Artificial intelligence. For example, to identify hunger-prone or health-deficient villages can be identified using AI.

- PM-GKAY (Gareeb Kalyan Ann Yojana) started by the government during COVID of providing free grains to poor was stopped. But at the same time, the National Food Security Act started during the Congress rule, which provides rice at Rs 2/kg and wheat at Rs 3/kg has been changed to provide these rations for FREE.

Chart depicting the share in revenues collected by government (Photo: NDTV)

Focus on CAPEX

One of the major highlights has been the high allocation for capital expenditure. The allocation for this year is Rs 10 lakh crores, which is double the amount allocated in 2020-21. The Railways too have received a record allocation of Rs 1 lakh crore. The economic logic behind this it is that the high capital expenditures will result in the generation of jobs and employment. But the flip side of the logic is that the effect is realised over the years and not instantly. Some economists also point flaws in the theory saying, “It’s like giving five vaccine doses in five years, when one vaccine instantly will be more effective.”

We have seen its example under this government only. After the economic recession India went through after demonetisation which took India’s growth rate to as low as below 4%, the government gave heavy relaxations in corporate tax rates expecting the corporates to pass on the gains and make new investments and create jobs. But, unfortunately that didn’t happen and the corporate kept their gains to themselves. Many economists point out at that time that the recession was not supply led but instead due to a lack of demand among the public. Some might recall, Finance Minister Nirmala Sitharaman as saying, “Why the Hanuman is not flying?” (implying that the corporates have forgotten their abilities like Hanuman).

The Neglected Areas

This rise in capital expenditure we are talking about, had to be made up from a reduction in something else. As a result the budget for welfare schemes and subsidies have been reduced by 28% (from 5.2 lac cr to 3.7 lac cr). MNREGA suffered the biggest jolt, as its allocation was reduced from Rs 89,400 cr to Rs 60,000 cr (lowest in last 5 yrs). It will lead to rise in the prices of gas, fertilisers and food. But, the bigger problem is that the allocations in the welfare schemes have been cut too. So, if the way the government wants things to pan out (focussing on capex), if it doesn’t happen, then the middle class and the poor will be facing a heavy brunt.

One thing, this government needs to understand is that in economic literature, there is nothing called ‘Revdi’. Most economists say that to develop as an economy we need to invest heavily in education and health. But, unfortunately, our budget has been reduced in these two areas. More surprisingly, this comes this comes after our dreadful health infrastructure got exposed during the Covid pandemic, when the recent ASHA study revealed the wide gap between the students whose education was hampered during the pandemic, and when our malnutrition condition has landed us at 102nd spot in the world.

Chart depicting share in the government expenditure (Photo: NDTV)

The Old v New Tax Regime Explained

One of the most confusing aspects of the budget has been the two tax regimes proposed by the government. I called this ‘confuson’, because it myself took quite some research to understand it. See, under the Old Tax Regime, out of a person’s total income, several deductions were made. This included your house loans, investment in National Pension Scheme (NPS), infrastructural government bonds, govt FDs, deductions on having parents, travel allowances and some more deductions as well. The tax was charged on the residual amount that came after making all these deductions. So, for example, out of Rs 10 lakh income, some Rs 2.5 lakh is deducted (say) and the tax is charged only on the Rs 7.5 lakhs remaining.

The New Tax Regime was introduced in April 2020 (under section 115BAC of the Income Tax Act). It aimed to ‘simplify’ the tax system and do away with the deductions. So, in 2023, there are three major developments in the tax systems. Firstly, from this year the now New Tax Regime will be the ‘Default’ option, so if you don’t purposefully opt for the Old one, your tax will automatically deduct by the New system. It clearly indicates that the government wants people to go for the new option. Secondly, the lower slab has been raised to Rs 3 L in the Old Tax system, and to 7 L in the New Tax system. Thirdly, under the New system, a standard deduction of Rs 50,000 has been introduced. Now, under the New system, you won’t have to pay the tax if your earning is under Rs 7 lakh, but as soon as you cross the 7 lakh bar (for example 8 lakh), you will have to pay the tax both of 3-6 lakh bracket (5% of 3L), as well as of 7-9 lakh bracket (10% of 2L).

The Income Tax slabs announced in the Budget (Photo: India Today)

If you actually sit down with a calculator, you will find that the ‘Higher your income is, the lesser the difference in your ‘payable tax’ in New and Old systems’. Now, above the income of Rs 16 L, there is no difference in the two tax systems, and above Rs 16 L, your tax in both systems will be EQUAL. But, the problem is for those who are under Rs 16 L, and mainly those in the 7-10L bracket. Because, for them, there is NO deduction (other than the 50,000 SD). Irrespective of your investments in home loans, bonds, Fixed Deposits, NPS or whatever, the tax will be calculated on your total income only (Rs 10 lakh in this case). Now, that means, the whole concept of ‘Tax Saving’ or ‘Saving’ has been done away with in teh new system, and it is only present in the Old system.

Earlier, the tax savings that was being done by the public, was going into the economy in some form of savings or investments. But, the government somehow believes that these savings are not doing enough, and instead, they want the public to spend that money. Now, those not much interested in saving, for them going into the new system is no big deal and is actually good. But, those who do invest and save in such things, mainly the middle class, their whole saving habit is being killed here. The economists too are quite sceptic about the outcome, as it will have a HUGE hit on the savings, mainly of the middle class. And, whether the spending will actually take place, it’s quite an uncertain thing.

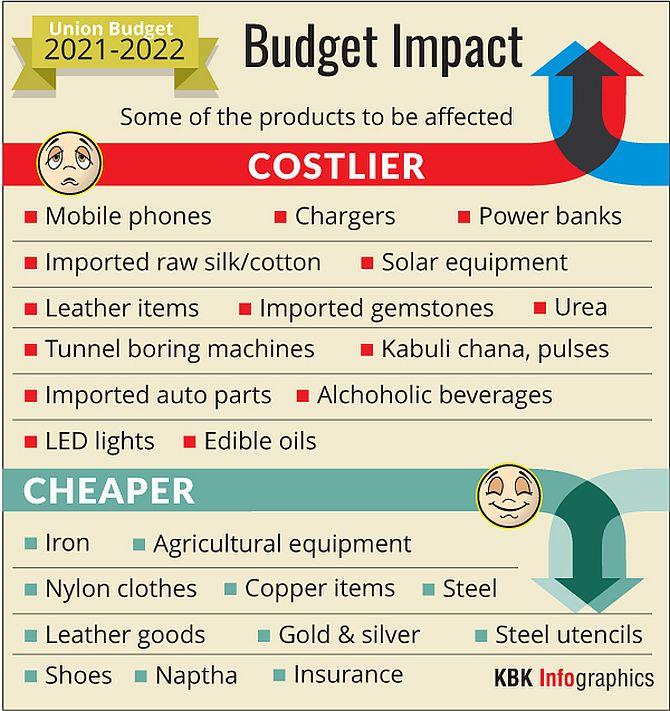

List showing products that will become cheaper and costlier (Photo: Rediff)

A Look at the Economic Survey

The Economic Survey which releases one day before the Budget on January 31, has projected India’s growth for the fiscal year 2022-23 at around 6.5% in real terms. Our Forex Reserves stand a very substantial $563 billion, and inflation is projected at around 6.8% (well ahead of target range). Interestingly, while the Economic Survey has projected 6.5% of GDP growth, the Budget has projected 10.5% of ‘Nominal GDP Growth’ (Real growth + Inflation). It means, that the Budget is ‘assuming’ the inflation to stay just around 4%, which is a little way too optimistic, because our inflation currently stands at close to 6%, and it won’t be coming down so soon. So, it remains to be seen how this pans out.

A major reason, why the government had to cut on the subsidies for investing in capex, is because of the constrained revenues. One of the principal reasons is the constant reduction in Corporate Tax, which has reduced from 3.7% (under Congress rule) to 3.3% (under BJP rule). However, income tax collection under BJP rule has risen considerably. Regarding the Fiscal Deficit, it came down heavily from 5.4% of GDP (under Congress) to 3.7% of GDP (under BJP). However, it rose steeply during COVID to as high as 9.2%. This year, Finance Minister has set the target for it to come down to 5.9% and then subsequently to 4.5% by 2026.

Chart depicting Ministry wise allocation in the Budget (Photo: Economic Times)

A Budget with Hits and Misses

With this Budget, one more conclusion is reiterated. There are three main pillars of governance of the Modi government. Firstly, HINDUTVA, which I don’t want to elaborate on now (HA HA). Secondly, Infrastructure (capex). As you all must have realised the government believes in heavily investing in building bridges, roads and flyovers. Not just it improves connectivity, but it also creates the perception of development in the minds of all people. This year too the allocations in railways and other infrastructure have been increased heavily. Thirdly, Welfarism, being a right-wing government, BJP has never shied away from using the ‘Left’ strategies for the people…and that is a remarkable thing. Whether it is free ration (the most effective), Awaas, Ujjwala or any other welfare scheme, this government has always shown its commitment towards pro-poor schemes.

One notable point in the Budget was the absence of any ‘populist measure’ as such, which is quite a brave thing to do in the last election budget. It also shows the confidence BJP has regarding the 2024 elections. However, if we remember, the PM-KISAN was announced right in the 2019 Interim Budget, so we can expect some surprises this year as well.

But, at the same time, one needs to understand that if the market could have solved everything, then there was no need for the government. The government has to play a big role in solving the missing piece in the market puzzle. So, the Budget does lack several things, whether it is the reductions in education and health, or the total absence of words like inflation, unemployment and inequality from the budget. It might not affect the ones reading and writing this, but will affect a large number of people in the country.

Overall, our economy is poised at a much better position than our counterparts, but still, there are areas that need to be worked on. Regarding the growth projection, even though I want that 6.5 thing to happen, I doubt that it will be the case. So, where exactly do we land remains to be seen. Now, when the Budget has come, there is a huge responsibility on the government to implement it properly, as it is not a big surprise to see a mismatch in planning and execution. Finally, I extend my best wishes regarding the implementation of the Budget and I hope we reach a respectable number in growth rates.