So … 1st of February … the day when every newspaper turns out a booklet and every Indian turns out an Economist. Just like any other year this year also the Budget was delivered by our finance minister NIRMALA SITHARAMAN delivered the budget for the fiscal year 2021-22. On some lines it was very much as per the predictions but on many fronts it differed completely from it. So let’s see from all points of view, the allocations and announcements of this budget and then conclude how helpful is this budget in these times. The budget was historic ….. come on not because its a once in 100 year budget as claimed by our FM (she even bluffly compared it with INDIA’s emphatic victory in Australia). Instead, the budget is Historic because it was the first ‘Paperless’ Budget in the history as it came in a digital tablet.

INFRASTRUCTURE :

Infrastructure seemed to be a prime focus for government in the budget.

- The major beneficiary turned out to be the Real Estate sector. Companies engaged in Affordable Housing or Affordable Rental will get an one year extension in tax holiday. The purchasers under these schemes will continue to get 1.5 lakh tax concession for one more year.

- Also the loans taken for purchasing houses of 45 lakh or below will continue to give 3.5 lakh tax concession for one more year. The process of direct investment in infrastructure will be made easier.

- A Development Financial Institution will be set up with a budget of 20000 crore for boosting the real estate sector. Government is also committed to provide 1.97 lakh crore loans over next 5 years

HEALTH :

One out of many good things this COVID has done is that, it has made people aware of importance and Health sector. In this budget, first after COVID-19, Government looked extremely serious and focused towards the Health sector.

- The allocation towards the Health sector more than doubled (137% rise) from 94,452 cr. to 2,23,846 cr.

- In addition to the existing AYUSHMANN BHARAT Scheme a new scheme PRADHANMANTRI ATMANIRBHAR SWASTH BHARAT YOJANA has been brought in with an allocation of 64,180 cr. to cover all those people who were not covered under the former scheme.

- 35,000 cr. has been kept aside specifically for CORONA Vaccines. Plus, endogenously made vaccine (Pneumococal) against Pneumonia will also be driven nationwide, estimated to save at least 50000 more children’s lives.

- Wellness centers across 70,000 villages is planned for reaching health amenities at small levels along with other healthcare centers across cities. The allocation in Drinking and ZSanitation has also been increased.

But some experts have pointed that this 137% rise is not actual because the allocation under ATMANIRBHAR Health scheme will not be realized fully this year but will be reaped by spreading out through coming 6 years. Also the allocation under Vaccine is a ‘One Time’ allocation and should not be counted as a strategic increase in healthcare sector. So, the overall increase in healthcare is not that big but still quite appreciable in my opinion.

INDUSTRIES:

Another major highlight of the budget was the Automobile sector for some peculiar policies with the aim of bringing it out of deep recession. Small sector businesses may see a change in their definition with more firms coming under this bracket and availing benefits.

- Now, any vehicle which is older than 20 years (personal) or 15 years (commercial) will have to undergo Fitness Test and if deemed unfit, it will have to be scrapped. As per estimates there are 6.3 such vehicles which will have to be scrapped. This move is expected to raise the demand in the Automobile sector, though a detailed roadmap regarding this is expected in next 15 days under the VOLUNTARY VEHICLE SCRAPPING POLICY (VVSP) with effect from 1st April 2022. Shares of automobiles rose sharply after this decision.

- In Textiles also, there are huge investment plans. There are 7 mega textile plan to be laid down in next 3 years. Also, out of 59 approved 22 of the ‘Mega Integrated Textile Region and Apparel’ has been made with the research labs.

- Start-ups have also been given encouragement. They don’t need to pay ‘Capital Gains Tax’ for one more year till 31st March, 2022. Under the EPO scheme, an employee is payable of tax only if he sells his share. Also, the MCA 21 3.0 is expected to bring e-security and reduce the legal expenses of the company.

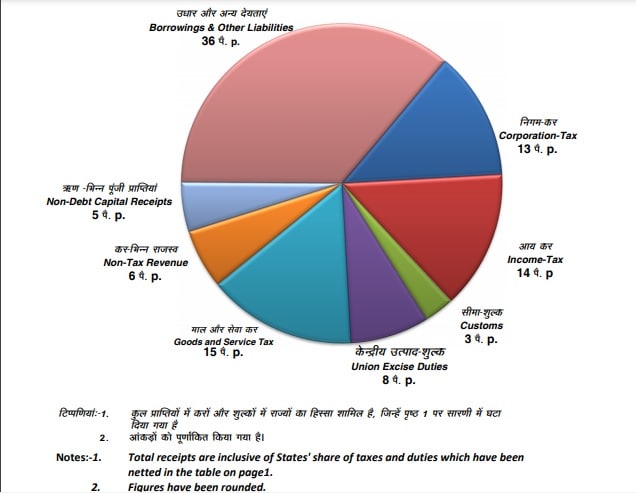

TAXES :

There were high speculations that government will have to increase taxes to recover its loss from the COVID-19 Pandemic. But, on contrary lines there were no changes in the tax slab and the same as prescribed last year will continue.

- There 77 amendments were made in the Income Tax Act. Such as the change in time limit of tax fraud reassessment and inclusion of a Return Form for tax payers constituting income from capital gain, shares and post office.

- Also, those earning interest from PF Deposit of over 2.5 lakh will have to pay taxes now. This idea seems under Radar keeping in mind that interest on PF goes in the market only so there isn’t any need of being taxable here, ethically.

- Now companies up to 10 crore turnover don’t need to get a Tax Audit from a CA (the limit has been increased from 5 to 10 crore). Limit has also risen from 1 to 5 crore amongst schools and hospitals run by trusts.

There was a very popular rumor going on that for the very first time all the senior citizens above 75 years have been barred from paying income tax. But actually they have only been barred from ‘Filing Return’, as the bank will itself deduct the tax from their accounts. So only the documentation and CA cost is barred, that too if they earn interest from the same account in which Pension comes or else some tax will be payable on them. I am just wondering why Finance minister bluffed so much exaggeratively saying “At the eve of 75 years of independence we give independence to those above 75…. blah blah” .

EDUCATION :

- Allocation to both school and higher education has increased.

- 4 crore students of backward caste will receive economic aid and also the governments schools will tend to be improved.

- Central University of LEH is another big announcement. 100 new Army schools will be opened with the help of private firms and NGOs.

Overall the allocation to education is still not up to mark (the prescribed 6% of GDP). Since this year was of pandemic, so I do expect the 6% number being touched in upcoming years.

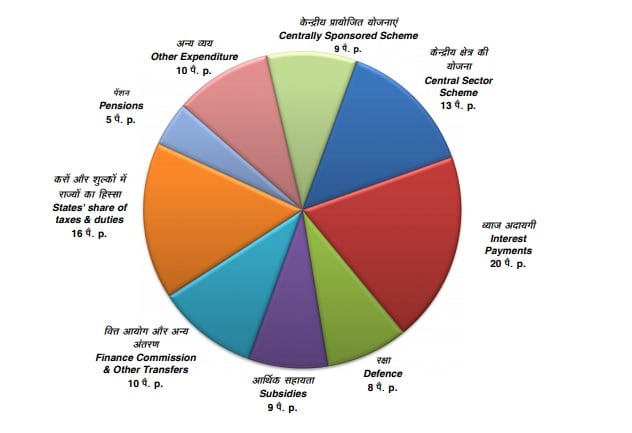

DEFENCE :

Interestingly, finance minister didn’t at all talked about the defense sector allocation during the whole speech and the amount was known only after the press release was out.

- The allocation was seen to have increased by 6000 crore to 4,78,195 crore.

- Out of this around 3.5 lakh crore will go as salaries and pensions of army personnel.

- So only 1.15 lakh crore is left for capital outlay and modernization of the three defense forces.

This amount is deemed highly unfit by experts considering the current tensions going on with China. But again we have to keep in mind that this is a Pandemic year and priorities are way too many.

RAILWAYS :

- This year saw a boosting investment towards the Railways sector as record outlay regarding Railways as 1.1 lakh crore was allocated for the purpose.

- Other than this 2.15 lakh crore has been kept for Capital Outlay. Also, Railways were provided with Special Loans of 79,938 crore for ‘COVID-19 related resource gap’.

- The government is also expecting its revenue from Railways to rise and reach up to 2.17 lakh crore

AGRICULTURE :

It was not a surprise that Agriculture will receive a good amount of the Budget’s focus considering the ongoing farmer protests in the country.

- The government has given an ‘Assurance’ that MSP will continue at 1.5 times of cost but anyway we still know that only 6% farmers are actually going to receive it.

- The allocation to KISAN SAMMAN NIDHI and other nutrient based subsidies have been reduced. So, to balance out a new AGRICULTURE AND INFRASTRUCTURE AND DEVELOPMENT CESS has been brought up. The money collected from AIDC will compulsorily be used in agriculture field only.

- Here, as a smart move government reduced the excise on all such products on which AIDC was levied to save the consumers from additional burden, especially Petrol and Diesel. But still some fruits, vegetables, cereals, cotton, soyabeans will have a price hike because of this Cess.

GOLD :

- INDIA is the country with highest private holding of gold and transactions of gold.

- Now under the Gold Trading Schemes, physical exchange and delivery of gold will also be made possible. The gold based bonds were there before, but now there will be ‘physical’ dealings of gold.

- Not only is it expected to bring a ‘Price Discovery’ but also it may turn out cheaper in terms of cost. SECURITIES AND EXCHANGE BOARD OF INDIA (SEBI) will undertake its working.

PRIVATISATION :

This term always stirs debate whenever is done. So was the case this time as well

- This time a major announcement came regarding LIFE INSURANCE CORPORATION (LIC), its IPO (Initial Public Offering) will be released in the market for public to purchase its share. The government will also disinvest its share in two more public sector banks.

- Also FDI has seen a major rise, even in Insurance sector the FDI limit has been recapped up to 74%.

- Other than this under, Disinvestment and Strategic Sale the government will sell its shares in many PSU’s such as Air India, IDBI Bank and many more organizations.

IMPORT AND CUSTOM DUTY :

- Electronic items, automobile parts, leather products, crude oil and food products, Ethyl Alcohol (ethanol is made out of it and used in cleaner fuels) all have seen rise in import duties which will hike their prices. Well … don’t worry, there are also some goods getting cheaper such as nylon products, shoes, electricity, and gold and silver as well.

- After a long time Government has increased both excise and custom duty. It is clearly a message that government wants to discourage imports of these products and wants these products to be produced domestically. It has both positive and negative aspects.

- Positive is that it will definitely pave the way for the country to be self-sufficient (ATMANIRBHAR) and negative is that if we don’t produce good quality products, then these duties will actually encourage below quality domestic products.

FISCAL FEDERALISM :

- The government has accepted the recommendation of 15th Finance Commission by keeping states share in pool of taxes at 41% for 5 years starting 2021-22.

- As a very good step the states have also been granted enhanced room for borrowing up to 4% of GROSS STATE DOMESTIC PRODUCT (GSDP), plus additional limit of 0.5% for those states dealing in some critical power sector reforms.

- The revenue deficits of 17 states amounting 1.18 lakh crore was also announced by our FM. Though the Finance Commission has also recommended additional revenue grant amounting 2.94 lakh crore for 17 states.

So overall. I think there has been appreciable moves for granting more power to states.

RENEWABLE ENERGY :

- This time there has been some considerably good allocations for various renewable energy sources such as hydrogen power plants and solar energy.

- Plus, there was a very interesting announcement of DEEP SEA MISSION researching within deep seas.

- Also, plants will be set up for extracting benefits from ‘Sea Weeds’, here as a matter of facts let me tell you that there are many benefits of seaweed … just Google it.

WORKERS :

- This budget has brought a great news for small workers working as gig and construction workers. Since they are not able to avail any employment, insurance or pension benefit because of being in Unorganized sector and not having any assured income.

- Now, a Portal will be brought in trying to take all these workers under one Umbrella and benefitting them with credit, health, housing and food schemes. They will also be able to avail the benefit of ONE NATION ONE CARD.

- There have also been some benefits announced for workers and their children working in tea plants in Assam and Bengal (Specifically these 2 states because there elections are due later this year).

So, in my opinion this is a very good perhaps the best scheme announced in the budget.

BAD BANKS :

Bad Banks will be set up with the purpose of clearing the bad loans. They will first purchase the loans on which payments are not coming and then will try to recover the loan as much as possible. The banks getting free of bad loans will be able to lend more freely leading to better economic circulation in the economy (if bad loans are high banks have to keep a decent share as contingency reserves for security). But this is not a new thing and have been tried before in other countries and as RAGHURAM RAJAN pointed out, bad loans are only getting transferred from one place to another but necessarily being resolved. But overall it is one of the many good reforms done by MODI Government in the bad loans sector and we can await what it brings on the table.

FISCAL DEFICIT :

The fiscal deficit of our budget is targeted at a whopping 9.5%. The number is extremely worrisome and dangerous. Why I am saying this is if you all remember, from the last few years the government was not able to meet its Fiscal Deficit target and was exhausting the target amount only in 6-7 months. By that trend, if that happens this year also then you can just imagine how serious and vicious cycle of interest rate, we will be trapped into. Also, we should remember that states will also come out with their budgets in upcoming days. If central government is having a deficit of 9.5 % what will be the status of states keeping in mind they don’t have big public sector institutions to monetize … so if anything will be monetized it will be our POCKETS.

Conclusion : A Very Good Effort constrained by Implementation

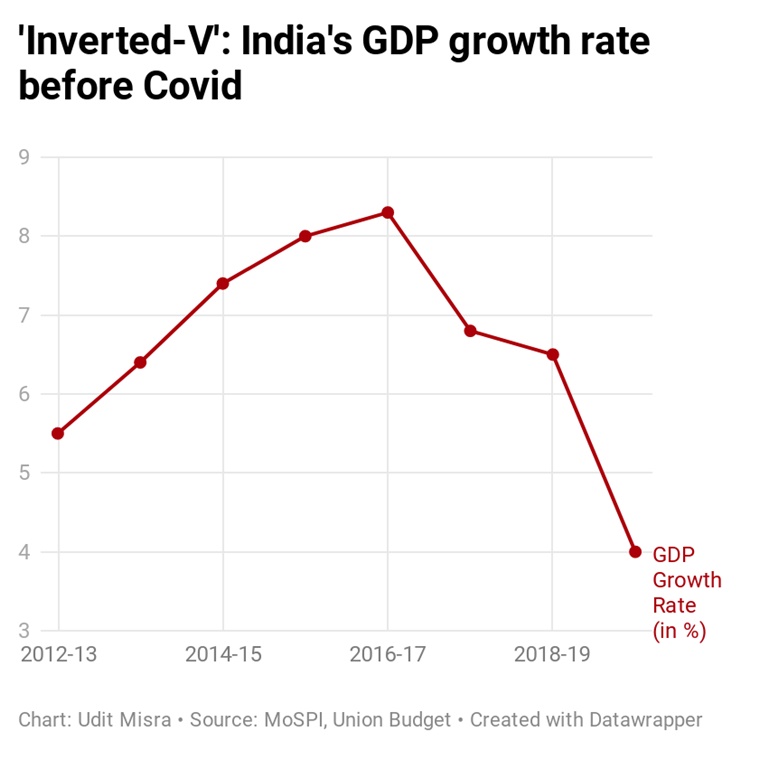

Since we are passing from the same road let’s also have a visit at the Economic Survey predictions (just a small brief). It is being predicted that we will have a huge jump with 11.5% growth rate in the year 2021-22 followed with 6.8% in 2022-23. So … our economy is revived and we have reached the ‘V Shaped Recovery’ ….. right … ????? Well … calm down a bit. We have actually been contracting from the past two fiscal years … aren’t we ? Then how come a 11.5% growth can be a great news. I mean … we are only reaching where we were around 2 years back. No … it’s not a growth, as we will just be growing at a rate below 7 again the very next year as I also said above. So, if we look at the larger picture here, scenario of last 5 years we instead see an ‘Inverted V Shaped’ trend.

So overall I will say that this is a quite good budget and as our FM also repeatedly said that “We have Spent … we have spent and we have spent”. The increased spending done by the government is definitely expected to bring a boost in investment which will in turn lead to greater employment. But one thing we all need to keep in mind that all these results that we are looking forward to depends highly or say completely on ‘Implementation’. As long as we don’t have proper implementation none of the above mentioned ideas can work. How much effect these reforms will bring in ‘Consumption’ will actually matter because that’s where we are actually struggling. A big Miss in the budget was not announcing any cash support for migrant laborers and other small laborers who had almost NO job during the whole Lockdown. Also we have examples where big announcements with great potential never actually took off properly such as Smart Cities. But, all and all a very good and brave attempt this is in the right direction, keeping in mind the times both we and the government have been in. At last we can just praise the effort and wish them all the best for the implementation and at the same time ensure that our contribution is too at its fullest wherever is required.

JAI HIND

ARUNESH SINHA