It was so shocking for everyone that URJIT PATEL the RBI Governor resigned 268 days before the end of his Tenure after the Fractious FaceOff with NaMo government over the Liquidity crunch , Interest Rate and Reserves in the economy . What the Hell is going on as what Boils my blood is the fact that his Predecessor RAGHURAM RAJAN was also not given Extension as everyone else in past had got . It was in the news from many days before that there is a Rift going on between government and RBI Governor . Though he has cited personal reasons but everyone knows the real reason of Exit . He has been the shortest tenured Governor since 1992 . The longest is RENEGAL RAMA DAU (July 1 1949 to January 14 1957) who resigned after differences with then finance minister TT KRISHNAMCHARI .

Everything started when the government decided to implement the Section 7 of the RBI Act which was never used in the 83 year old history of RBI . It gives Government the power to give directions to the Central Bank after consultation with him if it finds it in public interest . According to Volume I of The History of the Reserve Bank of India(1935-51) ; it was drafted after combining provisions of Section 4(1) of the Bank of England Act , 1946 and Section of Commonwealth Bank of Australia Act ,1945 . But it was also specified that if Government decides to go against the Governor it has to take the whole responsibility for the action and it was also hoped that it will be seldom exercised . The then finance minister was not in favour of draft and sought re-drafting . The Clause thus stated consultation with governor before issue by the Treasury but was silent on the situation if difference of opinion came between government and treasury . But consultation will ensure that Government is benefitted by Governor’s view on the matter . Later Section 7(1) was amended during Nationalisation in 1949 which gave government the power exercise directions to central bank in public interest according to Volume II of the Reserve Bank of India .

Issue of invoking this Act came during Hearing of Allahabad High Court in a case filed by Independent Power Producers Association of India challenging RBI 12 February Circular . The high court allowed government to issue Section 7 of RBI Act . After which government asked Governor’s view on the matter of exemption for power companies related to February 12 Circular . Again government on 10th October sought his views on using RBI’s Capital Reserve for providing liquidity to and then third one pertained to regulatory issues including withdrawl of Prompt Corrective Action (PCA) norms for public sector banks easing constraints on banks for loans to small and medium enterprises (SMEs) . Government had only initiated consultations on the matter and not invoked it .

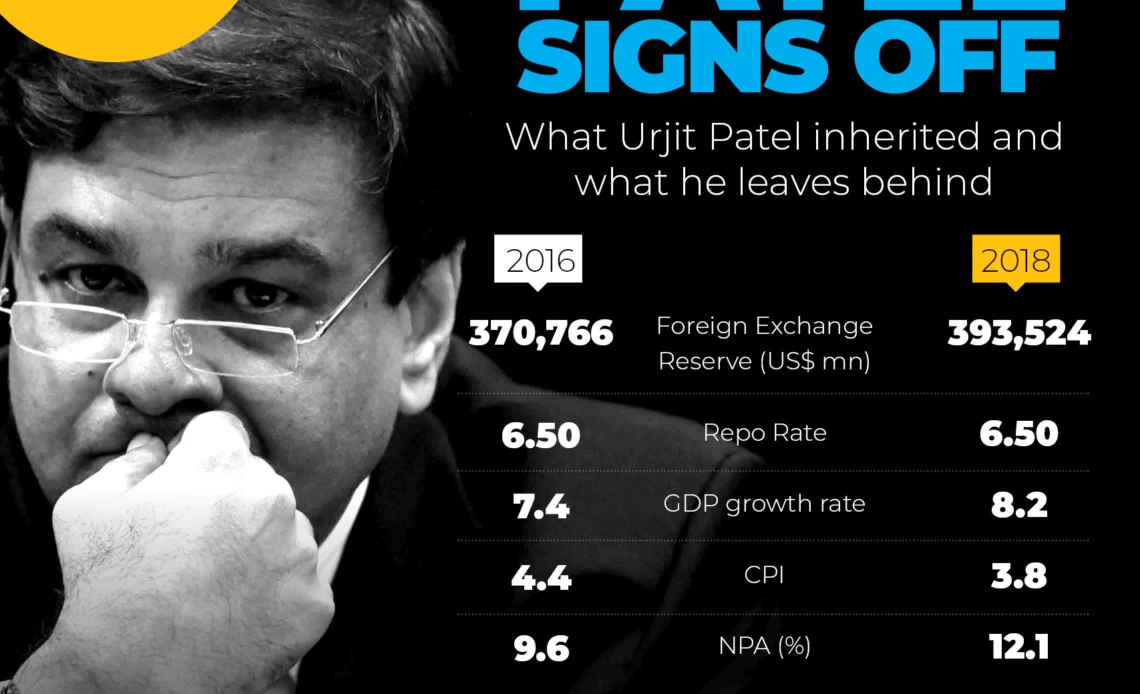

Even NaMo Tweeted and said that he steered our economy from Chaos to order and ensured Discipline and gained financial stability . In the first year he had to fight the ill effects of Demonetisation as Economy was having Cash deficiency and next year he faced challenge of Stabilizing the Rupee as it was on a Historic Low due to the disturbances coming due to US CHINA Trade War . During his tenure REPO RATE started from 6.5 , travelled through two stations to 6 and then travelled back to 6.5 BASIS POINTS (BPS which one hundredth of a Percentage) with the course of time . CPI INFLATION has remained almost steady above 4% which once touched as high 5% in Dec 2017 . BANK CREDIT which represents Healthiness of the economy ; started from 10.8% fell to 3.3% during Demonetisation but then rose slowly back to 10 and now it is 11 . NPA was already in the Crisis when he took the Office they had surged from 7.06 lakh crore to 10.03 lakh crore of which 90% was contributed mostly because of the public sector companies ; though Insolvency and Bankruptcy Code (IBC) has come in existence the Battle is still on . When he started RUPEE was around 67 ; got strengthened to 63 for quite a while but after then affected by Crude oil prices it fell by 11% to historic low of 71.18 . FOREX RESERVES were at 326 billion dollar fell to 359 , rose to all tume high of 426 and now us at 401 billion Dollar .

It’s noteworthy that he was appointed in September 2016 just before the DEMONETISATION DISASTER and he was highly criticized for being Silent on the matter . When he was appointed it was said that he is a OBEYER of NaMo as he didn’t criticized Demonetisation ; I have no idea of it’s Truth but in both cases government stands in Bar for it’s Attitude . It’s being said that Urjit Patel hinted of rate cuts in 2019 but government didn’t wanted it to happen as it will reduce deposits in Economy . It’s also to be noted that his predecessor Raghuram Rajan was not in favour of Demonetisation as he knew how Hard it’s Repercussions can be . He also said that if you want to Ban notes ; Okay but you have to keep the new notes very ready right from 00:00 of 8th November so that Money doesn’t runs out of Economy . But our highly educated Economist NaMo had other ideas and not only because of this RR resigned to resist the Setback but Namo went for the step which Badly Shook our economy and whose VIBRATIONS are still persistent . Also the implementation of GST was so badly done that it led to a situation where the whole world was growing but we were left behind .

I don’t know why Central Government thinks that Central Bank is a government department and it can order it to make Policies which can help in fulfilling it’s Electoral Promises , or we can say in bringing ACCHE DIN . RR has rightly said that if Central Government is the driver , Central Bank is the Seat Belt . Without seat belt you may feel more comfortable in driving but you don’t know that it’s absence is increasing your chances of Accident per second .

Opposition Jumped and took Fire against Centre ; AHMAD PATEL said it will bring Financial Emergency and country’s credibility and reputation is at stake , ARVIND KEJRIWAL said he was forced to resign because he didn’t allowed the centre to plunder the 3 lakh crore Reserve so they forced him out and brought a more PLIABLE person , SUBRAMANIAN SWAMY said it will be Bad for Economy , MANMOHAN SINGH said it’s very Unfortunate and a Severe Blow that Centre is diminishing institutions for short term political gains , RAHUL GANDHI also said BJP-RSS combo is assaulting and undermining Institutions and it should be removed from power . A startling fact is that he resigned on 10th December just 3 days after last Voting in the 5 state election and as per reports PM himself met him just after expectations arised that he is going to resign but then again news came that he will not ; many started to claim it as a Mature step but I think actually NaMo just insisted him to wait till Votings so that results don’t get affected due to it . See how Selfish Act this is that they are not concerned that a Notable Economist is leaving but concentration still lies with winning Elections .

RR also said that Autonomy of RBI is something which should not be played with . Other’s opinion don’t matter much but that of Economists need to heard with Care . Also Finance Ministry wanted to use the RBI Reserves as it will prove more Fruitful for any other purpose than being kept in RBI Vallets . But RR has clearly criticized this Idea and siad that doing this will reduce our Central Bank’s credit rating which is not very Appreciable currently . Further fall in rating will make it very difficult for Us to take loans from Big institutions . Even NITI AAYOG has said that we need atleast 8-9% Growth to keep Economy on right track and frequent changes in economic controller will hamper our Economy and that too badly . Another notable point given by RR was that this LOAN WAIVER is a big demon which should be removed from the system as it makes our Economy Hollow . The recently resigned governor was also not in favour of too much loan waiving but his DIFFERENT opinion costed him his JOB . Is that the reason we have selected this government that Jobs of Deserving are Lost .

How Illogical it seems that we are easily just waving off the loans which were given by banks from the deposits made by public only. Specially these political parties make these promises as if money is going from their Pockets ; we saw how CONGRESS made a Hatrick Victory using Loan Waiver Tool , not only them the ruling party also falls under this bracket . If loan is waived , from where the hell the Bank will get the money . Will government take the responsibilty and even if it takes it’s Tax Payer’s money only which is being Flown into Air . Also if someone thinks that farmers can be made better off by doing this , then it’s to your kind information that all the benfits of loan waiver are reaped away by the Hkgh off farmers only and poor and deserving farmer stay afoot from where they started ; and again this Vicious cycle of demanding Loan Waiver continues .

The only way one can solve this FARMING problem is by FARMING in a better way . We know that almost 50% population is involved in Agriculture so we should use it as our Power imstead of crying it as our Weakness . There are many techniques to increase productivity in Farming and specially ISRAEL has adopted and uses most of them . So I would like to ask genuinely that instead of wasting more than 10000 crores on Advertisement of never done jobs shouldn’t government have worked on this and that too when NaMo shares a very good friendly realtion with Israel . But instead of that we are busy in making Statues using public money , bringing Bullet Train on loan and changing City Names to show HINDU Dominance .

A notable point is that his resignation came just 4 days before the RBI Meeting of Dec 14 which would have discussed issues of simmering differences with government ; so just imagine how Worse the situation had become that he couldn’t even wait for the meeting . He is not the first Economist who has left us ; apart from these 2 ; NITI Aayog Vice Chairman ARVIND PANAGARIYA and SURJIT BHALLA (Member of Economic Advisory Council) have also resigned quite a while ago . I don’t know how is it possible for a Developing country to run properly without a Independent RBI Governor and absence of Scholar Economists . Just after the news of his resognation broke Stock market crashed badly and situaion of Uncertainty arised and even SEBI and stock exchanges had to step up their surveillance system to keep a check on manipulative forces in check amid extreme volatility .

The post of RBI Governor is a very delicate post and if one has to select it requires too much discussion and thinking but our new Governor was selected in less than a day of his predecessor’s resignation . SHAKTIKANTH DAS who has worked with Finance minister Arun Jaitley and the Finance Ministry earlier also and also during DEMONETISATION phase and he also PRAISED it . Maybe now you have understood why he is selected . On one hand we see that his two Predecessors have extremely high Degrees that too from World class universities abroad our current Governor is BA and MA in History from St.Stephen’s College . It was also argued that why He also has done ADVANCED FINANCIAL MANAGEMENT COURSE (IIM Bangalore) and DEVELOPMENT BANKING AND INSTITUTIONAL CREDIT (National Institute of Banking Management) as well but these are not regular Degrees . But we have to keep in mind that only degrees don’t define Talent ; for example MS DHONI never went to Cricket Coaching specially WICKET KEEPING but many players who spent their lives practising Wicket Keeping but still lie nowhere near the Best Wicket Keeper in the world . So it may be the case with him as well but I am not too assured with the fact that he is a Like to Like replacement for his predecessors specially RR the Guy who was the first to predict THE GREAT DEPRESSION .

I can’t be too sure of Economy performing well under him but I am Damn sure that he will not have differences with the government and a Smooth run of Economy will take place but everything Smooth is not good for health sometimes Roughness makes you Tough for facing adverse situations . But one thing is very clear that the approach this government is showing specially for the Economy is not at all Acceptable . Even if we become too Rich but don’t know how to use money properly we will be lying on the brink of collapse.

JAI HIND

ARUNESH SINHA