The Narendra Modi government presented the last budget of its second term on February 1. The sixth budget presented by Finance Minister Nirmala Sitharaman was one of the most bland and ‘dull’ budgets in a long long time. It also being Sitharaman’s shortest (58 minutes) further underscores this point. It is important to note that this interim budget has come in the election year when the usual expectations are of many populist announcements, but the nature of this budget itself shows that the Modi government is pretty confident of returning to power and presenting a full budget later this year. In this Blog, I will try to look at the major announcements and economic outlook ahead of the general elections.

Major Allocations

A major announcement (and also most keenly watched) was no changes in the tax slab. The government cited that tax collection has risen ‘multifold’ in the last 10 years, with the number of tax filers shooting 2.4 times and GST collection also doubling. It also claimed that the processing time of tax returns has reduced from 93 days in 2014 to just 10 days, and refunds have also been made faster.

In another major relief for the taxpayers, the government announced withdrawing outstanding direct tax demands up to Rs 25,000 until FY 2009-10. Similarly, outstanding direct tax demands up to Rs 10,000 for financial years 2010-11 to 2014-15 were also withdrawn. “This will benefit one crore taxpayers.”

The biggest allocation was on expected lines as per BJP’s record, towards Capex (capital expenditure), where the allocation was increased by 11.11% taking the total figure to a whopping Rs 11,11,111 (HA HA). The capital expenditure as a percentage of GDP which rose to 3.3 per cent in 2023-24, is estimated at 3.4 per cent in the next financial year.

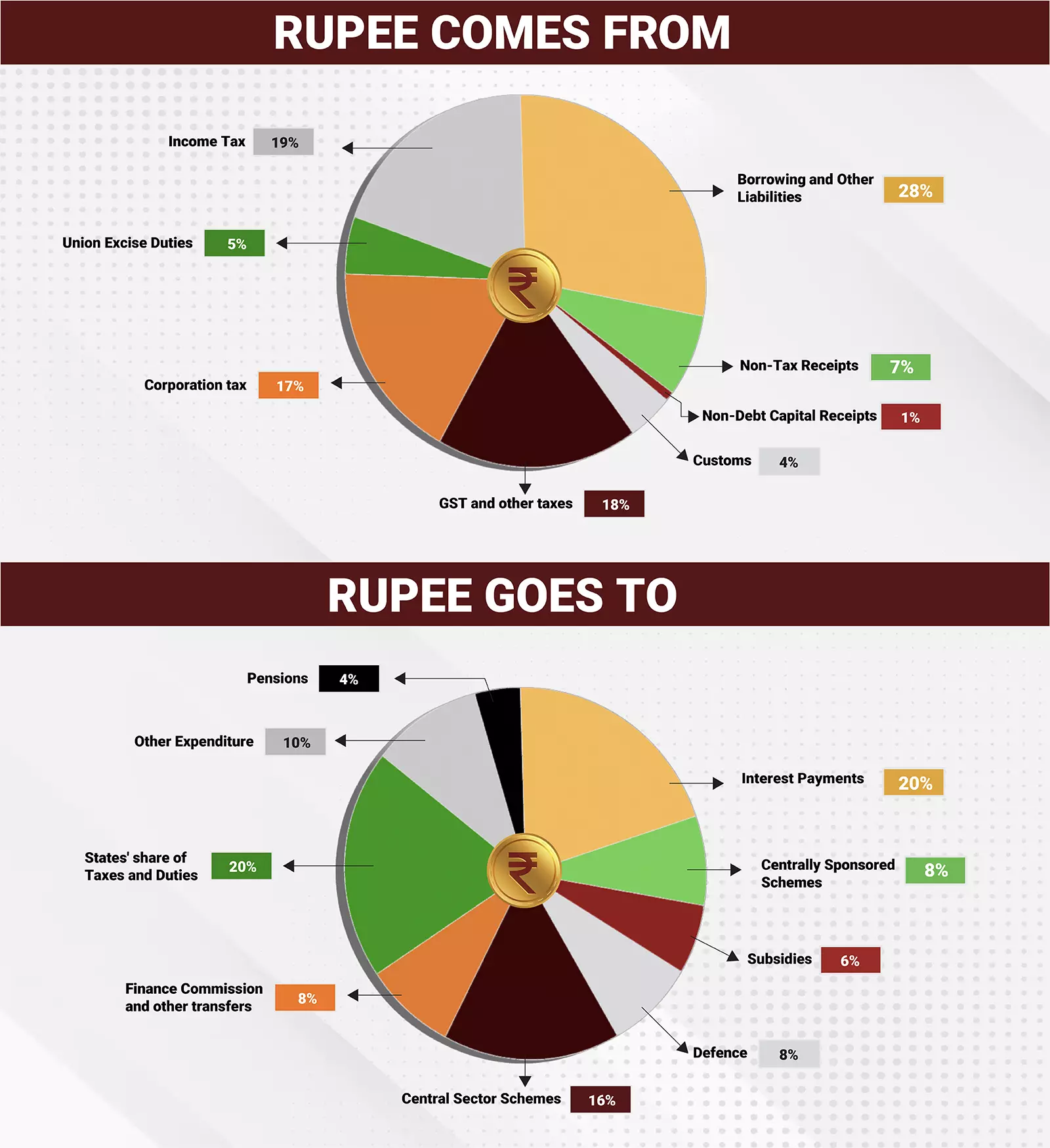

Pie Chart explaining the major allocations and major sources of revenues for the Union government (Photo: The Federal)

Other Announcements

Among other announcements, the Defence Budget was modestly increased to Rs 6.21 lakh crore a modest hike of 4.72 per cent from last year’s allocation of Rs 5.25 lakh crore. Agriculture was allocated Rs 1.27 lakh crore, again a slight increase. A big boost came for the automobile sector, where a seven-fold increase in allocation was made through the Production-Linked Incentive (PLI) scheme amounting to Rs 3,500 crore. A very positive announcement was that of connecting 1 crore homes with free power via solar panels.

The Ministry of External Affairs (MEA) was allocated a total of Rs 22,154 crore up against last year’s outlay of Rs 18,050 crore. In line with India’s ‘Neighbourhood First’ policy, the largest share of aid has been granted to Bhutan of Rs 2,068 crore. Chabar Port also looked a major priority with a a Rs 100 crore allocation. The two most irking allocations came for the Taliban and Maldives — 220 crores and 770 crores respectively. While Taliban one can be understood as there are big Indian investments in Afghanistan, the Taliban one (which increased from 400 to 770 crores) seems more of a diplomatic move amid the diplomatic row.

The allocation for Education and Health continued to be disappointing, as while the UGC budget was slashed by 60%, IIIM was cut down from 608 crore to 300 crore and IITs too had a slight dip. There was also nothing encouraging for Research and Development (R&D). While major economies spend around 3-4% of their GDP on R&D, we are struggling to even take this number beyond 1%. The value of human capital should never be compromised.

Surprisingly, the Modi government announced that it will form a high-powered panel to address “population growth challenges and demographic changes”. Now, she hasn’t revealed much about it, so it will be interesting to see what steps are taken when India’s fertility rate has already reached replacement level (2.1).

The graph shows Fiscal Deficit over the years, which the government has projected to bring at 5.1% this fiscal (Photo: PMF IAS)

Economic Projections

Surprisingly, the Economic Survey — presented weeks before the presentation of the Budget — was not presented this year as this was an interim budget. But the government did come up with a document ‘The Indian Economy: A Review’. On expected lines in an election year, the document bifurcates the pre-Modi and post-Modi years and calls the last decade that of “transformational growth”.

The Finance Minister informed that this year, the government will borrow a gross of Rs 14.13 lakh crore as compared to Rs 15.43 trillion for the current fiscal (2023-24). The government has also made a provision of Rs 750 crore for 50-year loans to states to boost their capital investments for the next fiscal year. It had provided Rs 1.3 lakh crore for such loans in this fiscal.

Now, from the economic point of view, a major projection of the ‘nominal growth rate’ was at 10.5%. Now, this is a very ‘ambitious’ target I have to say. See, nominal GDP effectively means (Real Growth + Inflation). So, as the RBI has projected the Indian economy to grow at around 6.5%, it means the Modi government is aiming to tame inflation below 4%, which is going to be a mounting task, as inflation currently stands well above 5.5%.

Another ambitious target set by the Modi government in the Interim Budget is bringing down the Fiscal Deficit (difference between expenditure and revenue) to 5.1% of GDP (around 16.85 lakh crore) from the 5.8% of GDP as per the revised estimates for 2023-24 which was at 5.8% of GDP (around Rs 17.34 lakh crore). Now, why I am calling this target ambitious because it is not entirely clear how will the government compensate for it in the revenue section. Keeping in mind, the government has failed to realise its disinvestment target since the 2020 budget. As of January 31 this year, the disinvestment receipt stood at Rs 12,500 crores against a target of 51,000 crore. So without making up for that, the target would be difficult to realise.

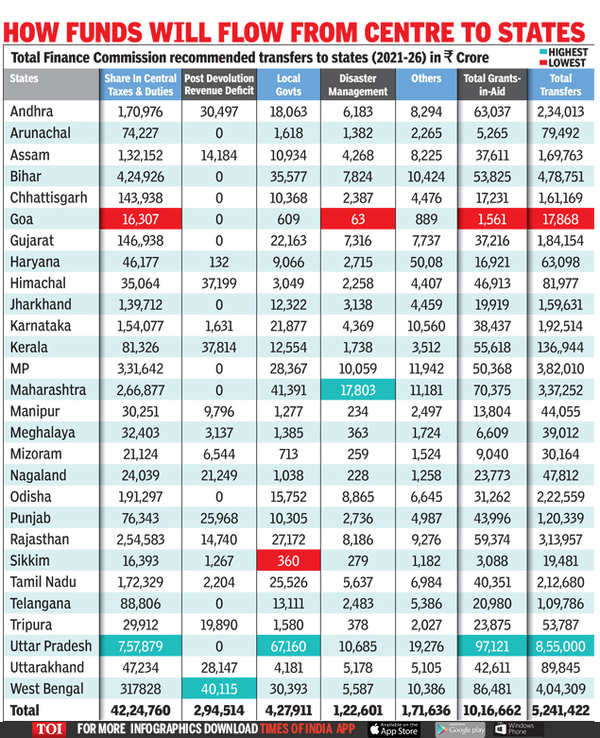

Table showing the allocation of funds by the central government to respective states (Photo: Times of India)

North v South Allocation Divide

A major debate that started after this Budget was that of huge gaps in the allocation to the states of North and South. A major example pointed out was that while UP has been allocated close to 2 lakh crore, the combined allocation of all five southern states is around Rs 2 lakh crore. As a result, four southern states held protests at Jantar Mantar in Delhi against this gap (Andhra Pradesh hasn’t said anything because their CM is a not so daring).

Firstly, we have to understand how the allocations are done. The major factor that the Finance Commission takes into account is the population of the states, followed by the gap in average income from the national average. So, it is understandable why Bihar, Madhya Pradesh or Uttar Pradesh have such high allocations. On the other hand, the reason for the gap doesn’t seem ‘entirely’ political or else this BJP government would never had allocated 91 lakh crore to West Bengal.

But, at the same time, the southern states should not be penalised for having better per capita income and low fertility. Maybe, this is something, the next Finance Commission should look at closely before the full budget next year. Also, the deplorable comments made by Congress leader DK Suresh on ‘carving a separate country’ will only worsen the case here.

Also, a very disturbing report came to light that stated that Mr Modi after assuming office tried to reduce the allocations for the state. According to NITI Aayog Chief Executive Officer BVR. Subrahmanyam, PM Modi had tried to get the 14th Finance Commission to reduce its recommendation of share for states from 42% to 32%. Now, this again puts a very bad precedent on the front of federalism, and especially at a time when ‘cooperative federalism’ is so much talked about.

The ‘Black and White’ Paper

The Budget session took a major political turn when Finance Minister Sitharaman announced that the BJP government will table a ‘White Paper’ on the economic mismanagement (2004-14). In the document, BJP alleges that Congress inherited a “healthy economy” in 2004 but due to its “economic mismanagement” turned it into a “non-performing” one. It calls out the multiple corruptions in the areas of Commonwealth Games, Coal scam, 2G and others related to defence. In a strong criticism, the BJP also said that Congress “abandoned” the 1991 reforms, which were brought by them only.

“The decade of the UPA government was a lost decade because it failed to capitalise on the strong foundational economy and pace of reforms left behind by the Vajpayee government. The potential of compounding growth never happened,” the document read. “The Amrit Kaal has just begun and our destination is ‘India a developed nation by 2047’. It is our Kartavya Kaal”.

The Congress too came up with a ‘Black Paper’ targeting the BJP government over the social, economic and political “injustices” in the last 10 years. The criticism is on expected lines of price rise, unemployment, farmer distress, misusing agencies and even toppling of governments. It also said that BJP’s politics of “hatred, polarisation and divide” has destroyed the ‘social fabric’ of the country.

“The Modi government’s 10 years in power have devastated the country’s economy, aggravated unemployment, destroyed the country’s agricultural sector, abetted crimes against women and committed grave injustices against minorities in the country,” Congress stated. “The Congress ensured the country’s independence and in 2024, it will take the country out of BJP’s ‘darkness of injustice’.”

A notable point in both the papers is the ‘demonetisation’. While Congress has termed the 2016 demonetisation a “blunder” adding that the economic effects of the “disastrous demonetisation” seven years ago continue to “haunt” the country even now, BJP has not even mentioned the word in its paper, after praising it for the initial years. It is an indication that the 2016 exercise has turned out to be a major embarrassment for the BJP, and they themselves don’t want to talk about it anymore.