On February 1st, the NDA government presented its 11th full budget. While every budget has talking points and some highlighting features, this one turned out to be particularly special, as perhaps for the first time, the government provided a huge relief to the Middle Class. The tax relief up to income of Rs 12 lakh is a welcome step for the Middle Class, which has long felt neglected by almost every government. So, here is my Blog on the Union Budget 2025-26, its economic aspects, major announcements and what impact it can have for the economy.

Modi and the Middle Class

While assessing Prime Minister Modi’s long-standing success, people often assume that it’s all because of ‘Hindutva’, which is actually true to a certain extent, but not fully. Other than the far-right Hindu group, Mr Modi’s huge and loyal support base happens to be the middle class. The ‘tea seller becoming PM’ (rag-to-riches story), resonates very well with the section. Combine this with aggressive Hindutva, (the othering of Muslims and “keeping them in check”) and it was just enough to keep this flock in support of the BJP, even if, it has to come at the cost of rising prices, massive unemployment, and slow economic growth.

But, slowly as happens with almost everything, the BJP realised this support was waning. A prime example of this was seen in the last Lok Saha Elections, where a huge section drifted away reducing BJP’s thumping win to a reduced 240-seat majority. Finally, it was clear that aggressive Hindutva can’t be the sole driving factor behind votes. So, finally, it became inevitable for the ruling party to provide a handsome incentive to the middle class, which we all saw on Feb 1, in the form of the huge and unexpected concession from income tax up to income of Rs 12 lakhs.

Ad if you are smart enough, you ca realise how the economic relief to the middle class comes close to the Delhi Elections (I’ll talk on this later).

The Economics behind the move

Now, after the idea and rationale behind the move are clear, let’s understand the economics behind it, and how the government which tries to appear cautious of budgetary spending, took this bold step.

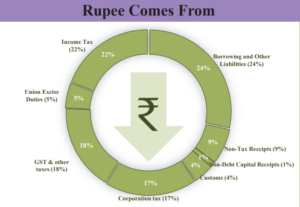

Firstly, in India, around 43 crore people come under the ‘Middle Class’ bracket, roughly 31% of the population. At the current tax bracket (before this announcement), the number of people filing Income Tax Returns (ITR) is 7.9 crores, out of whom 63% of returns drew 0 tax (including me). It was only 3.8 cr which was actually paying the income tax. Now, according to government expectations, 1 crore more people will get the relief, which will keep the number of actual taxpayers at 2.8 cr, and will lead to a reduction of 1 lakh crore in the revenue, which the government aims to recover through more tax compliance (tax collection grew 4.5% between 2019 and 2024), more tax on capital gains (those benefitting might invest in stocks and mutual funds) and other means.

Another important data, around 48% of tax-payers come under 5-15 lakh income, and 33% earn over 15 lakh. And, a surprising number…only 38 lakh (out of 2.8 crore taxpayers) pay 73% of the total income tax. So, the actual benefit will accrue only to a few lakh people and the critics remain sceptic, about whether this small section has the capability to boost the economy through increased spending.

Another important conclusion that we can draw after this decision is, that there will be no respite in indirect taxes; GST and tax on petrol-diesel. There has been huge criticism of the government imposing huge GST even on essential items like medical insurance (Eve Nitin Gadkari wrote a letter to Sitharaman over it) and who can forget that infamous popcorn GST controversy. All this was also building pressure to give some respite on GST. But, this income tax has ensured that there will be no relief on that end.

Finally, I would also like to clarify that this proposed tax exemption will only accrue to those using the New Tax Regime and those using the Old Tax Regime. It has also become aptly clear that the Old Tax Regime will not be there for long and, ultimately, it will be the New Tax Regime covering the whole income tax system in the country.

Other Major Announcements

Some other major announcements in the budget included the Pradhan Mantri Dhan Dhanya Krishi Yojana. The scheme aims to develop agri-districts, on the same lines as the Aspirational Districts Programme (2018) which worked to transform 112 most under-developed districts across the country. The PMDDKY, which will be implemented in partnership with the states, will cover 100 districts with low productivity, moderate crop intensity, and below-average parameters.

Additionally, the government aims to facilitate short-term loans to facilitate short-term loans for 7.7 crore farmers, fishermen, and dairy farmers with enhanced loans of ₹5 lakh. Some other plans are to launch a 6-year Mission with a special focus on Tur, Urad and Masoor. 50,000 Atal Tinkering Labs to be set up in government schools in the next 5 years.

In an appreciable move, the government aims to include gig workers (around 1 crore) under the PM Jan Arogya Yojana (Ayushman Bharat)

The government has announced a scheme of 50-year interest-free loans to states for capital expenditure and incentives for reforms.

The Finance Minister has also announced that the cap on Foreign Direct Investment in the insurance sector will be removed, allowing 100% FDI in the sector (earlier it was 74%). The move is aimed at attracting global investments in the sector and achieving the goal of ‘Insurance for All’

An attractive announcement is the Rs 10,000 crore Fund of Funds Scheme (FFS) for startups, which will help support startups especially those involved in manufacturing and high-technology sectors. The Alternate Investment Funds (AIFs) for startups have received commitments of more than 91,000 crore.

An Export Promotion Mission will be set up with an outlay of Rs 2250 crores, which will help firms get easy export credits, cross-order factoring support and tackle non-tariff measures.

Additionally, some tall-claim targets were announced. First, FM Sitharaman announced that the government wants to make India a ‘food basket’ of the world. For this, the National Institute of Food Technology, Entrepreneurship and Management will be set up. The second major target is that of making Idia a global hub of ‘toys’, which may sound a little funny but can be good for the economy.

Focus on Bihar

It’s very obvious that a state going to the polls will remain the focus of attraction and this was the situation in Bihar this time. Going to polls this November, Bihar saw its name being mentioned multiple times in the Budget.

Finance Minister Sitharaman announced the expansion of Patna Airport, the establishment of four new greenfield airports, and the construction of a brownfield airport at Bihta. She also highlighted the Western Kosi Canal ERM project in the Mithilanchal region of Bihar. The government will also set up a special Makhana board in Bihar to improve production, processing, value addition, and marketing.

Fiscal Health

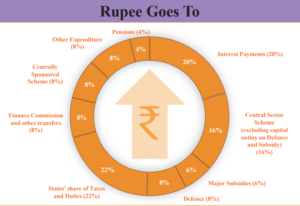

One major highlight was the government’s decision to bring the fiscal deficit down to 4.4% from 4.8% in 2025-26.

The Centre is on track to achieve a fiscal deficit of 4.8% of GDP in 2024-25, with a further reduction to 4.4% targeted for 2025-26, Finance Minister Nirmala Sitharaman announced.

This is going to be a challenging task, but good from the point of fiscal prudence. Notably, the fiscal deficit for this year will be around 4.7-4.8%, it lower than the 4.9% target.

The net borrowing for 2025-26 has been pegged at Rs 11.5 trillion, lower than Rs 11.6 trillion in FY25

Additionally, several announcements have been made regarding the expansion of credit, which aims to make taking loans easier for businesses and MSMEs.

As I said, above, capital gain tax, GST and disinvestment will play major roles in government revenue. This time, FM Sitharaman has announced that the government will monetize Rs 10 lakh crore worth of assets.

Final Comments

So, these are the primary traits of the budget. And, after a very long time, one can say it is a quite decent budget, especially if you look from the point of boosting consumption. The relief (even though not that big, as I explained above) is good enough to spur some consumption, which is actually the need of the hour for the Indian economy. On other fronts, the budget is just fine. Many announcements take place, but much will depend on how much the implementation caters to the ground.

Regarding economic growth (most crucial aspect), the government has kept expectations around 6.7%. So this number continues to hover in the 6-6.8% range, which is extremely low compared to what India should be growing at, considering our population and potential. Just repeating the so-called ‘Viksit Bharat’ 10 times a day won’t help if we are not growing at a healthy rate to actually realise the target of a developed nation. So, let’s see how much this budget helps the economy, how many announcements are actually realised and what growth we eventually register this year.